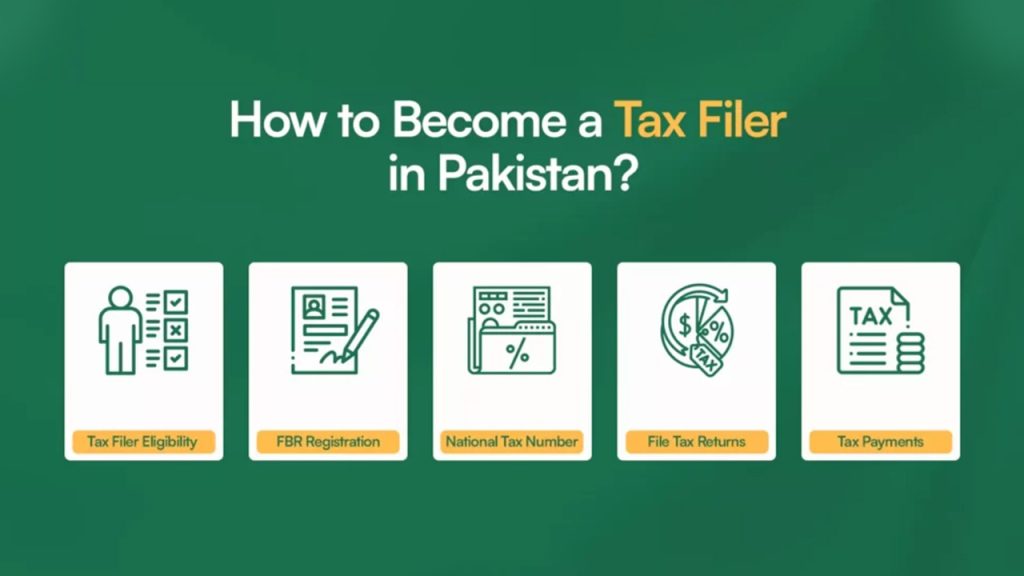

Here’s a step-by-step guide:

Becoming a tax filer in Pakistan involves a few steps to register with the Federal Board of Revenue (FBR) and submit your tax returns.

Obtain a National Tax Number (NTN):

- For Individuals: Use your Computerized National Identity Card (CNIC) number as your NTN.

- For Businesses: In case of sole proprietor, individual NTN shall also be used as business NTN but in case of Association of Persons (AOP) / Partnerships or Private limited Company/Limited Company NTN shall be provided separately upon registration.

Register with the FBR:

- Visit the FBR Iris portal.

- Click on “Registration for Unregistered Person” and provide your CNIC, email address, and phone number.

- You’ll receive a PIN code via SMS or email to verify your registration.

- Once registered, log in to the FBR Iris system using your credentials.

Complete Your Profile:

- After logging into the FBR portal, complete your personal profile, including information like bank account details, address, employer (if applicable), and income sources.

- Make sure all information is accurate to avoid issues later.

File Income Tax Returns

- Go to the “Declaration” section in Iris to file your income tax return.

- Enter your annual income details, including salary, business income, rental income, etc., and any deductions (e.g., Zakat, charitable donations).

- Submit your income tax return for the current fiscal year.

(For tax return filing, it is advised to seek expert services of “Taxfiler Pakistan” team at https://taxfilerpakistan.com/)

Tax Payment

- If you owe taxes, the system will generate a Payment Slip Identification (PSID) that you can pay through a bank or online transfer.

- Payment is necessary to complete the process of becoming a filer.

Verification and Active Taxpayer List (ATL)

Once your return is successfully submitted and any tax dues are paid, you will be added to the FBR’s Active Taxpayer List (ATL). You can check your status on the FBR website.

File Annually

To maintain your filer status active, you must file your returns every year. Failing to do so will result in being dropped from the ATL list and losing the benefits of being a tax filer. By following these steps, you can successfully become a tax filer in Pakistan and enjoy the associated benefits.